When we take a deeper dive into the recent Gould+Partners study about PR firm profitability, it looks like another case of the rich getting richer ( PR News, June 12, p. 8).

Managing Partner

Gould+Partners

As managing partner Rick Gould, CPA, JD, says in an interview, “The industry is not improving on profitability, other than the larger firms…which are pushing 20%, the mid-size firms are at about 18%, which is respectable…the small ones are just going backward at 13.5% [profits]…You can’t grow with only 13% profitability. These firms are just going to stagnate and won’t increase in value.”

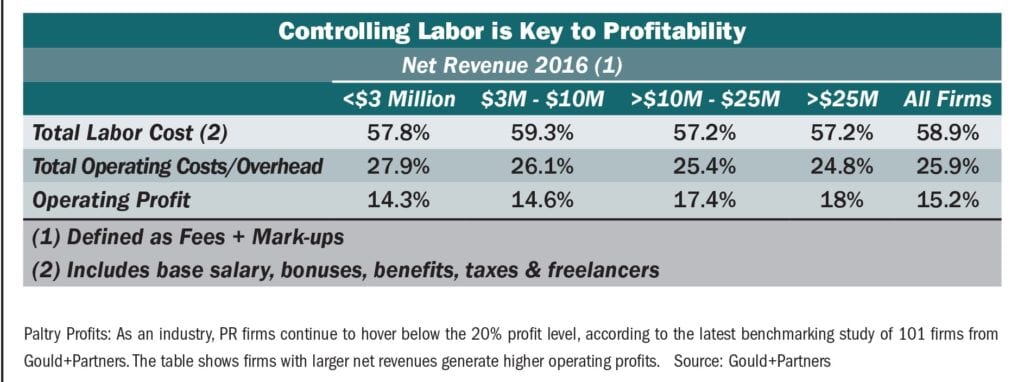

Rick Gould Managing PartnerGould+PartnersThe survey of 101 firms showed U.S. PR agencies registering a modest 15.2% profit last year, down slightly from 15.3% in 2015 and 16.2% in 2014.

As you can see from the table, firms with net revenue less than $3 million had operating profits of 14.3%; those with net revenues greater than $25 million posted profits closer to 20%, which is where firms should be, Gould says.

The culprits are labor costs, which, Gould says, firms need to keep at 50% or lower to reach acceptable profit levels. When firms deliver additional services, they need to bill clients accordingly, Gould notes. Due to concerns about losing clients, they often fail to add fees for additional service to their bill, he says. The happy medium is “to give the client the service it needs, but charge accordingly for it.”

Why are larger firms able to control labor costs that the mid-size and smaller firms can’t? “Large firms not only have CFOs [chief financial officers] who can manage the financial day-to-day of the business, but they also have chief operating officers [COO]. I think that might be the missing link.”

COOs can spend time looking at efficiency with VPs, Gould says, and figure out which teams are most productive. “I think that might be the answer…that smaller firms are weak operationally where the larger firms aren’t. They have systems in place and their time management gives them great feedback to avoid scope creep,” or overservicing. “An operations person can stop [over services before it has a big impact on the bottom line.”

And if you’re a modest-size firm and feel you can’t afford to hire a CFO and COO, Gould advocates getting part-timers. If funds were extremely tight, “I’d hire the part-time CFO first. Get the financials in shape and a few months later go for the COO. I don’t look at [such hires] as overhead, I see them as an investment. They pay for themselves. I’ve seen it work over and over again for firms that are struggling” to reach the 20% profit level.

“Get your C-suite right,” he adds. “The CEO should be out there bringing in new business, not worrying about finances…most PR people aren’t trained to handle finances.”