Different Online Paths for Different Purchases |

|

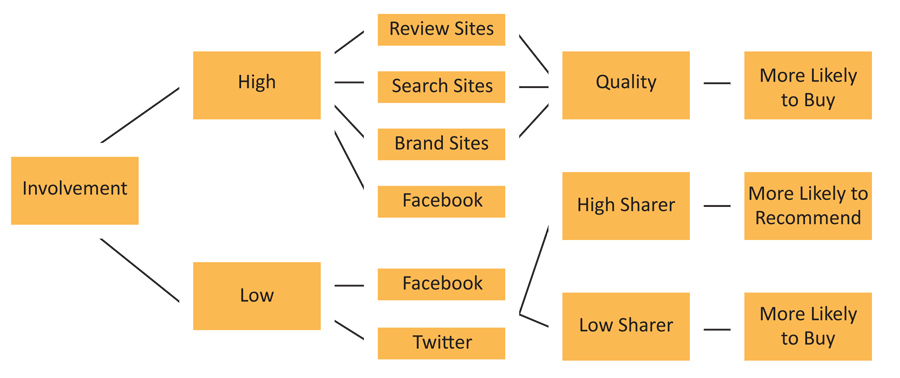

| According to an M Booth/Beyond study, the types of online channels reflect a different level of influence depending on the product type involved. For example, when researching a “high involvement” product like a car, consumers are more likely to be influenced by review sites, search and the brand’s own site. Consumers researching a less risky and less expensive “low involvement” buy are likely to be influenced by the more informal social platforms, such as Facebook and Twitter. |

Research on social media released in October 2011 by PR agency M Booth and digital shop Beyond gets enticingly close to answering questions about how followers impact a brand’s bottom line, and what it really means when a person likes or follows a brand.

But does the study get close enough? The “Science of Sharing” report makes the case that product categories involve different decision paths (see chart) depending on the type of product (high and low involvement) and the type of consumer (high- and low-sharer).

Definitions: a high involvement product is a risky, big-ticket item like a car; l ow involvement products are impulse buys—less costly and involving minimal decision time. A high sharer creates content (by posting videos, links, writing posts about the brand, liking or following brands), while low sharers infrequently use social channels and seldom post original content. To maximize one’s impact across multiple channels, the study suggests that brands understand the path that their customers are most likely to take before designing a social strategy.

The question is, does this study put communicators any closer to understanding social media ROI? “The study seems to show that demographics and purchasing power play into a consumer’s likelihood to share,” says Jason Winocour, partner at Hunter Public Relations. “The low sharers are purchasing higher-ticket items less frequently, which actually limits the amount of times they can share with their friends about the purchases that matter most to them.” On the other hand, the high sharer tends to be younger and will share more frequently because of how comfortable they are with online platforms and partly because they are purchasing less expensive items more often.

Interesting to be sure, but, says Winocour, what is still a mystery is the result of the sharing. “The impact of sharing is not something that is discussed in the survey, which I think is key to identifying the true significance of the science of sharing.”

Christine Perkett, CEO of Perkett PR, struggles with the study’s statement that “the degree to which someone has a propensity to share is an important factor in determining his or her role in other people’s path to purchase.” Perkett feels that high participation matters more than high sharing. “That is what builds trust, community and influence. Just because someone regurgitates a brand’s social content doesn’t mean I’m going to hold their opinion in high regard,” says Perkett.

For Winocour, the findings of the survey highlight the importance of knowing your audience and knowing which social media channels are most important to them. Seems like we’re back to square one. PRN

CONTACT:

Jason Winocour, [email protected]; Christine Perkett, [email protected].