The news is sobering for PR firm profitability in a new survey from Gould+Partners. The 226 N. American firms surveyed grew a modest 4.8% in 2016. Most categories of firms grew less than they did in 2015.

The 78 firms with revenue of $3 million-$10 million had a negative growth rate of 1.4% in 2016. The 49 firms in the $10 million-$25 million revenue group topped the growth list at 8.1%. The 39 firms with revenue of more than $25 million grew 4.8%. The 60 firms with net revenue of less than $3 million grew 7.3%.

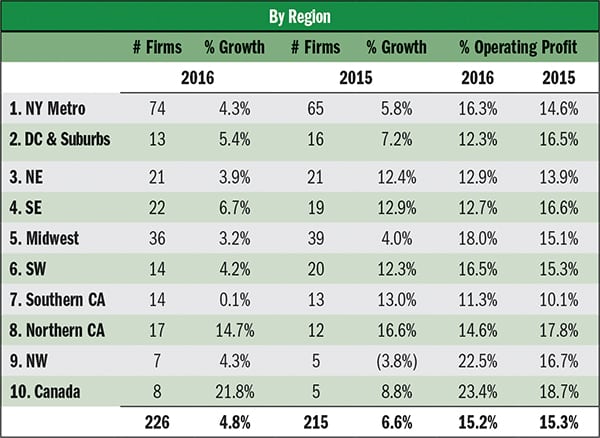

The two charts below show growth and operating profit by region. In the U.S., the Southeast region topped the charts. Canada bested the U.S.

We asked Rick Gould, CPA, J.D., managing partner, Gould+Partners, what’s ahead for the industry. “I see it going only one way, further south.” He calls the 4.8% growth figure “dismal…I believe the only way we will see a turnaround is if PR agency management proactively increases billing rates as it give raises every year. If not, we will see both profitability and growth continue to the decreasing trend.”

He has a special message for the firms with net revenue of $3 million-$10 million mentioned earlier, which he says are stuck in “growth gridlock.” Gould urges them to “take a hard look at your benchmarks in relation to firms that are growing at least 10% yearly, with net operating profit at more than 20%.”

What does all this mean for PR pros expecting raises for the rest of the year? “Firms must give market raises each year or they will lose good people, which will have a snowball effect on profitability, value and the quality of work,” Gould says. “If they give market raises every year and don’t increase billing rates and retainers proportionately, however, they will take a further hit on their bottom line.”

Gould’s findings were consistent with its Best Practices Benchmarking report ( PRN, June 26, 2017), which showed operating profit down slightly to 15.2% in 2016 from 15.3% in 2015 and a billing/utilization report from July, which showed billing rates failed to increase during 2016 at the same pace as salaries and costs ( PRN, July 10, 2017).