Digital communications makes nearly all actions and results quantifiable. This should enable communicators to have an easier time proving the value of their work. But if all actions lead to data, what does data lead to? Merely proving value isn’t enough—not if senior leaders have a bias about the business value of PR, beyond getting favorable coverage in the Wall Street Journal.

Communicators must take the next step with data. They need to turn communications data into into larger business goals instead of using it to prove one’s worth as a communicator ( PRN, November 7, 2017). Easier said than done.

“Sometimes we get so excited with data that we put everything in” presentations, says Shilpa Mehta, Google’s principal analytical. “Often, dashboards are not one-page affairs but rather 28-tab Excel files or 34-slide PowerPoint decks...it’s nearly impossible to distill a cogent understanding of what happened and what action should be taken.” The takeaway: “Be a communicator, not a dump truck.”

Andrew Bowins, executive director, corporate reputation, KMPG, (picture, page 1) says communicators need to evolve from being “deli-counter providers of data reports to being a strategic partner and provider of insights to the enterprise.”

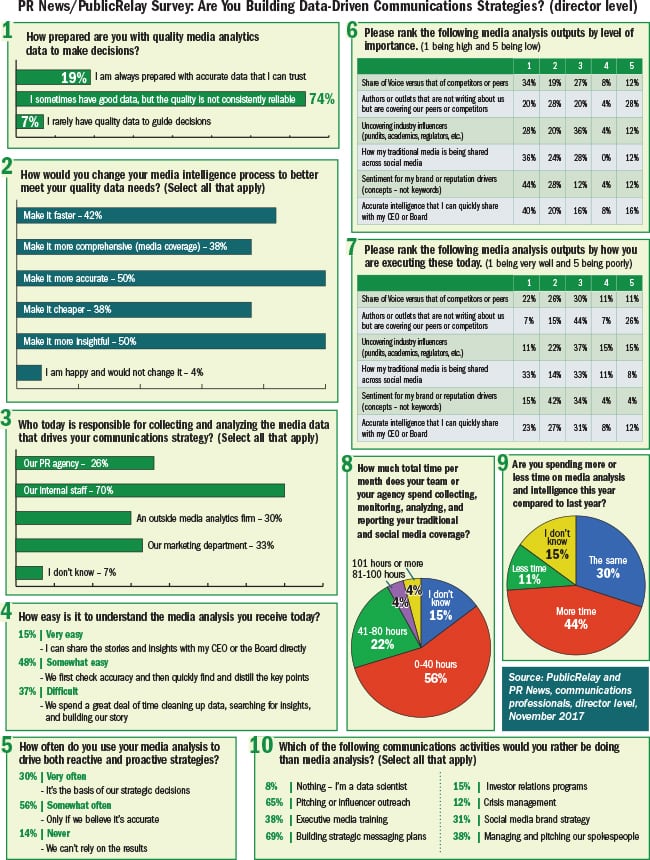

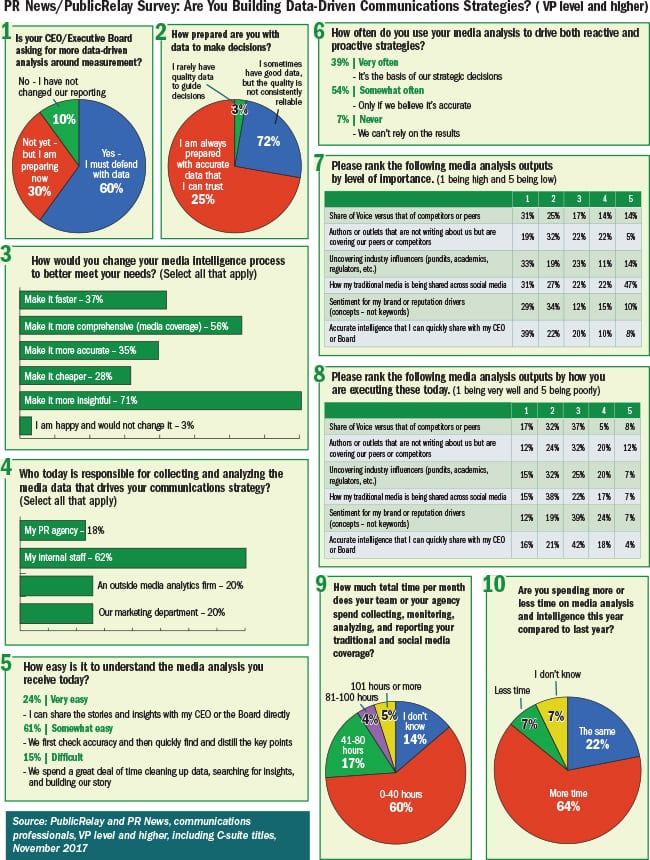

To gain a better understanding of the day-to-day role of measurement and media analysis, PR News and PublicRelay, a media monitoring and analytics firm, surveyed in October-November 2017 select communicators at the director level and, separately, at the VP level and above.

Lacking Consistently Reliable Data

We learned there is profound uncertainty about the uses of data and of the value of the communications data that’s shared with senior leaders. Nearly 75% of director-level communicators said, when asked how prepared they are with quality media analytics data to make decisions, that they “sometimes have good data, but the quality is not consistently reliable.”

Only 19% of director-level communicators said they are prepared with accurate data they can trust.

Similarly, 72% of VP-level and above communicators said they have good data sometimes, but the quality is not consistently reliable. Only 25% of respondents in this group said they are always prepared with accurate data they can trust.

For VP-level and above communicators, the sense of a lack of reliable data is compounded by growing demands from CEOs and executive boards for more data-driven analysis. 60% of respondents said they are under increasing pressure from above to defend their work with data.

Speed of data collection and the cost of analytics are less important to respondents than the accuracy and insightfulness of data. Better accuracy and insight were ranked the most important changes they wanted to see in their media intelligence process, above speed, lower cost and comprehensiveness of media coverage. This was the case for both director-level and VP-level and above respondents.

Directors-VP Divide on Data

Nearly 40% of director-level communicators are finding it difficult to understand the media analysis data they’re receiving, saying they spend a great deal of time cleaning up data, searching for insights and building their media analysis story.

On the other hand, VP-level and above communicators are finding it easier to understand the media analysis data they’re receiving. Roughly 25% of respondents said it’s easy for them to share data-centered stories and insights with the C-suite directly; 61% said it’s “somewhat easy....”

The proliferation of data has been a mixed blessing. Theoretically, data should provide business insights and align communicators more closely with business goals. The reality is more complex. Asked if they are spending more or less time on media analysis and intelligence this year compared to 2016, 44% of directors and 64% of VP-level and above communicators said they are spending more time. When asked which activities they’d rather be doing than media analysis, 69% of directors said building strategic messaging plans and 65% said pitching or focusing on influencer outreach.